The school choice movement is gaining momentum across the country, making private Christian education accessible to many...

Looking For a Few Good Families

by ACCU Staff on Nov 6, 2023 3:04:54 PM

This guest blog post was provided courtesy of our friends at Nightlight Christian Adoptions.

ACCU Offers Financial Products and Services With a Faith-Based Approach

by ACCU Staff on Sep 27, 2023 9:23:16 AM

This blog post was provided courtesy of CardRates.com

The ABCs of Adoption Funding

by ACCU Staff on Aug 3, 2023 4:26:07 PM

This guest blog post was provided courtesy of our friends at Nightlight Christian Adoptions.

Covenant Journey Academy Selects ACCU as Financial Partner

by ACCU Staff on Jun 7, 2023 11:37:03 AM

ORLANDO, FL – This week, Covenant Journey Academy (CJA) announced a new partnership with America’s Christian Credit Union...

Adoption Bridge

by ACCU Staff on Apr 28, 2023 9:30:00 AM

This guest blog post was provided courtesy of our friends at Nightlight Christian Adoptions.

Adoption is Affordable

by ACCU Staff on Mar 31, 2023 8:00:00 AM

By Camie Schuiteman

This guest blog post was provided courtesy of our friends at Nightlight Christian Adoptions.

“Embryo Adoption? I’ve never heard of that before!”

by ACCU Staff on Mar 24, 2023 9:30:00 AM

This guest blog post was provided courtesy of our friends at Nightlight Christian Adoptions.

Recent Bank Closures: A Moment of Clarity

by ACCU Staff on Mar 13, 2023 4:50:30 PM

ACCU has been receiving calls from individuals and organizations looking to transfer funds out of their current financial...

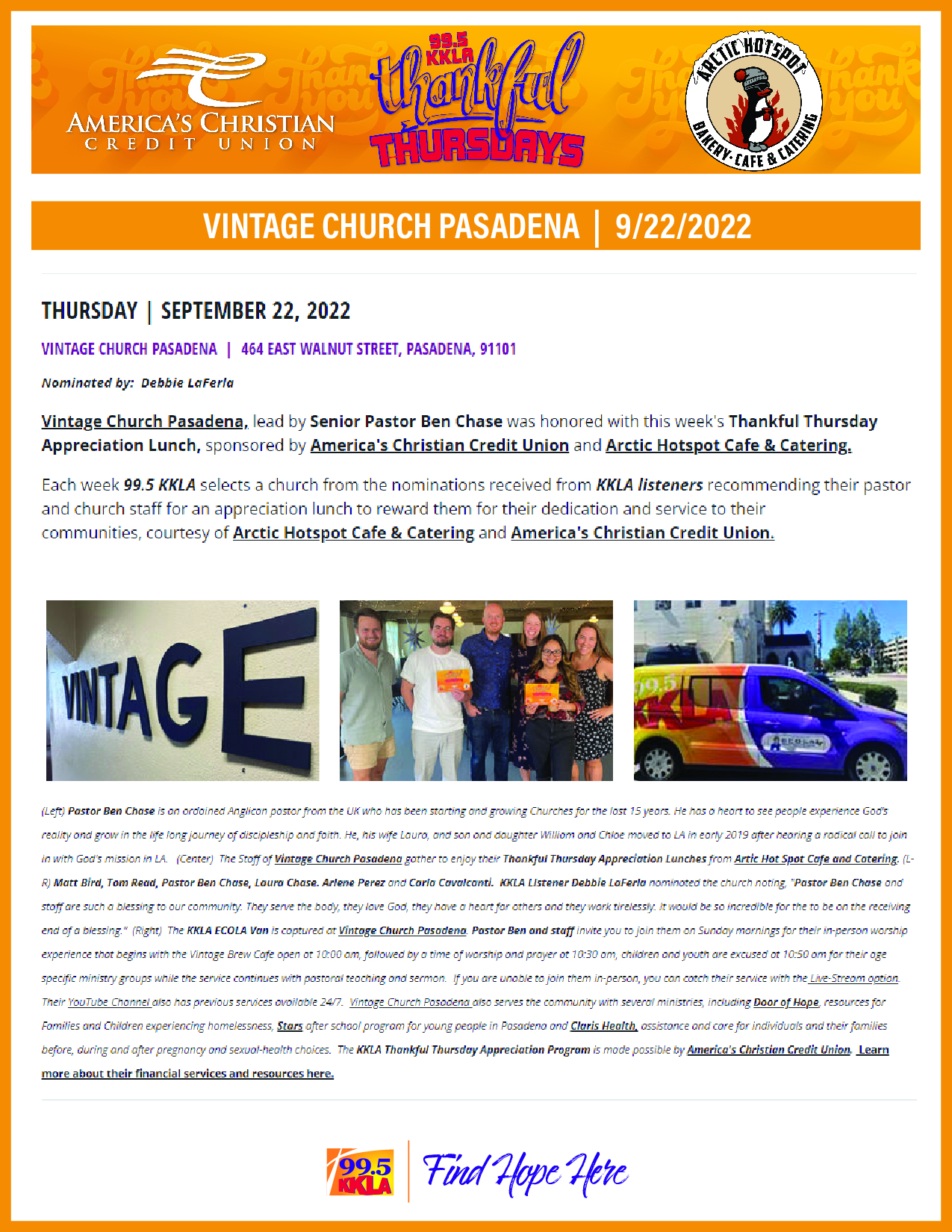

Thankful Thursday - Vintage Church Pasadena

by ACCU Staff on Sep 23, 2022 3:00:00 PM

America’s Christian Credit Union (ACCU), is grateful to partner with 99.5 KKLA and their Street Team for Thankful...

![]()

Terms & Privacy | Federal Privacy Notice

© 2024 Americas Christian Credit Union. All rights reserved. If you are using a screen reader or other auxiliary aid and are having problems using this website, please call (800) 343-6328 for assistance. All information available on this website is also available at any of our branches.

All rights reserved: The blog owner, administrator, contributor, editor and/or author reserve the right to edit, delete, move or mark as spam any and all comments. We also have the right to block access to any one or any group from commenting, or from the entire blog.

Hold Harmless: All comments within this site are the responsibility of the commenter, not the site owner, administrator, contributor, editor or author. By submitting a comment on our site, you agree that the comment content is your own, and to hold America’s Christian Credit Union and all subsidiaries and representatives harmless from any and all repercussions, damages, or liability.

Private responses via message, email or other “non-public” internet communications may be made public by ACCU.

As always, if you have any comments regarding any issue related to ACCU, you can call us on our toll-free number 1-800-343-6328.

This credit union is federally insured by the National Credit Union Administration. Added savings protection provided by American Share Insurance (ASI) on qualifying member’s accounts in excess of that provided by NCUA. ASI is a credit union owned-share guaranty corporation. Equal housing opportunity.

Personal Accounts:

Federally insured by the National Credit Union Administration to $250,000.

Excess coverage by American Share Insurance, for consumer accounts up to $200,000.

Organization Accounts:

Federally insured by the National Credit Union Administration to $250,000.

Excess coverage by American Share Insurance, for organizational accounts up to $100,000.